Introduction:

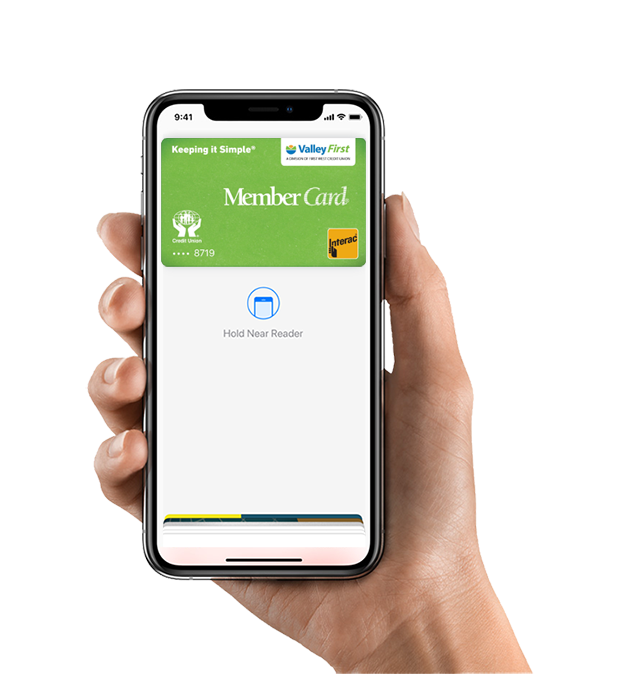

These Terms of Use govern your use of the Apple Pay service to make a payment with an eligible Credit Union debit card (“card”) on any Apple® device that supports the use of Apple Pay (“device”).

Please read these Terms of Use carefully. These Terms of Use are a legal agreement between you and us. If you add, activate or use your card for use of Apple Pay, it means that you accept and agree to these Terms of Use. In these Terms of Use, "you" and "your" means each Credit Union member who has been issued a Credit Union card. "We", "us", and "our" mean Credit Union.

Other Documents and Agreements:

These Terms of Use are in addition to, and supplement, all other agreements between Credit Union and Member regarding Credit Union’s products and services. If there is any conflict or inconsistency between these Terms of Use and the other agreements, then these Terms of Use will take priority and govern with respect to the Apple Pay service.

You understand that your use of Apple Pay will also be subject to agreements or terms of use with Apple Inc. and other third parties (such as your wireless carrier and the websites and services of other third parties integrated into Apple Pay).

Use of Cards in Apple Pay:

If you want to add a card to Apple Pay, you must follow the procedures adopted by Apple, any instructions provided by us, and any further procedures Apple or we adopt. You understand that we may not add a card to Apple Pay if we cannot verify the card, if your account is not in good standing, if we suspect that there may be fraud associated with your card or for any other reason we determine at our sole discretion. Apple Pay allows you to make purchases using your card wherever Apple Pay is accepted. Apple Pay may not be accepted at all places where your card is accepted.

Removal, Blocking, or Suspension of Card

We may not permit the addition of a card to Apple Pay, or we may remove, suspend or cancel your access to Apple Pay at any time, if we cannot verify the card, if we suspect that there may be fraud associated with the use of the card, if your account is not in good standing, if applicable laws change, or for any other reason we determine at our sole discretion.

You may suspend, delete or reactivate a card from Apple Pay by following Apple's procedures for suspension, deletion or reactivation. In certain circumstances, your card may be suspended or removed from Apple Pay by Apple.

Maximum Dollar Limit:

Payment networks, merchants or we may establish transaction limits from time to time in their or our discretion. As a result, you may be unable to use Apple Pay to complete a transaction that exceeds these limits.

Applicable Fees:

We do not charge you any fees for adding a card to Apple Pay. Please consult your card agreement for any applicable fees or other charges associated with your card.

Your mobile service carrier or provider, Apple or other third parties may charge you service fees in connection with your use of your device or Apple Pay.

Security:

You must contact us immediately if your card is lost or stolen, if your device is lost or stolen, or if your card account is compromised. If you get a new device, you must delete all your card and other personal information from your prior device.

You are required to contact us immediately if there are errors or if you suspect fraud with your card. We will resolve any potential error or fraudulent purchase in accordance with the applicable account agreement.

You agree to protect and keep confidential your Apple User ID, Apple passwords (including your fingerprint set up for Touch ID, if applicable). If you share these credentials with others, they may be able to access Apple Pay and make purchases with your card or obtain your personal information.

Before using Apple Pay you should ensure that only your credentials and fingerprints are registered on your device as these will then be considered authorized to make transactions related to your card. If the fingerprint or credentials of another person are used to unlock your device or make transactions, these transactions will be deemed to be authorized by you.

You are prohibited from using Apple Pay on a device that you know or have reason to believe has had its security or integrity compromised (e.g. where the device has been "rooted" or had its security mechanisms bypassed).

Apple is responsible for the security of information provided to Apple or stored in Apple Pay.

Liability for Loss:

You are solely responsible for all account transactions made using your card processed through Apple Pay. You are responsible for the completeness and accuracy of the account information you enter into Apple Pay. Only the individual member whose name is associated with the card should add the card to Apple Pay.

Privacy:

You consent to the collection, use and disclosure of your personal information from time to time as provided in our privacy policy, which is available on our website. We may share with or receive from Apple such information as may reasonably be necessary to determine your eligibility for, enrollment in and use of Apple Pay and any Apple Pay features you may select (for example, your name and details such as card number and expiry date).

Apple may aggregate your information or make it anonymous for the purposes set out in its privacy policy or terms of use. To help protect you and us from error and criminal activities, we and Apple may share information reasonably required for such purposes as fraud detection and prevention (for example, informing Apple if you notify us of a lost or stolen device).

Communications:

You agree to receive communications from us, including emails to the email address or text message to the mobile number you have provided in connection with your card account. These communications will relate to your use of your card(s) in Apple Pay. You agree to update your contact information when it changes by contacting us. You may also contact us if you wish to withdraw your consent to receive these communications, but doing so may result in your inability to continue to use your card(s) in Apple Pay.

No Warranty and Exclusion of Liability:

For the purpose of this Section, “Credit Union” means Credit Union and its agents, contractors, and service providers, and each of their respective subsidiaries. The provisions set out in this section shall survive termination of these Terms of Use.

Apple Pay service is provided by Apple, and Credit Union is not responsible for its use or function. You acknowledge and agree that Credit Union makes no representations, warranties or conditions relating to Apple Pay of any kind, and in particular, Credit Union does not warrant: (a) the operability or functionality of Apple Pay or that Apple Pay will be available to complete a transaction; (b) that any particular merchant will be a participating merchant at which Apple Pay is available; (c) that Apple Pay will meet your requirements or that the operation of Apple Pay will be uninterrupted or error-free; and (d) the availability or operability of the wireless networks of any device.

Credit Union will have no liability whatever in relation to Apple Pay, including without limitation in relation to the sale, distribution or use thereof, or the performance or non-performance of Apple Pay, or any loss, injury or inconvenience you suffer. You may want to consider keeping your physical card with you to use in the event you cannot make Apple Pay transactions.

Changes to the Terms of Use:

We may change these Terms of Use or the agreements associated with the use of your card with Apple Pay. You agree to any changes to these Terms of Use or agreement(s) associated with the use of your card or account by your continued use of your card with Apple Pay. If you do not accept the revised Terms of Use or agreement(s), you must delete your card from Apple Pay.

Contacting Us:

You may contact us about anything concerning your card or these Terms of Use by calling the phone number found on our website.

If you have any questions or complaints about, or disputes with, Apple Pay, you should contact Apple.