REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

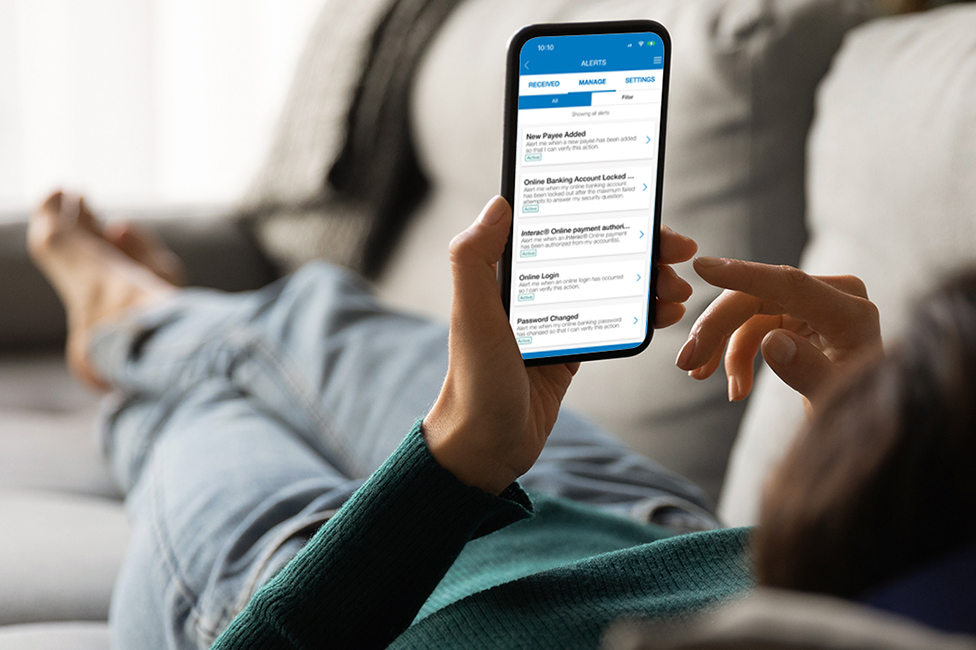

Looking for peace of mind in today's digital world?

Account alerts might be the answer.

By enabling notifications for unusual transactions or account activity, you can quickly identify and address potential threats, or prevent unwanted fees.

Account alerts are an easy way to stay on top of your account activity. They're free and easy to set up, you can select the notifications that are most important to you, and you can opt out at any time!

Get an email, text or both, when important activity happens on your account. For instance:

To set up alerts in online banking:

To set up alerts in the mobile app:

You can check the Alerts sent to you on the Alerts History page of online banking—there you'll find all the Alerts sent to you within the last 30 days.

If you don't have access to Online Banking, call us at 1-888-597-8083 or visit your branch and we'll be happy to set that up for you.

Log in now to get started

Everything is easier with a little help.

We acknowledge that we have the privilege of doing business on the traditional territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian